学术前沿

an intermediary enhances outgroup trust and ingroup profit expectation of chinese but not australian

by jiawen ye and sik hung ng

department of applied social sciences, city university of hong kong

department of psychology, renmin university of china

international journal of psychology 2015. doi: 10.1002/ijop.12100

research background

❖ trust-distrust dilemma

in daily life we often have to decide whether to trust others

whose trustworthiness is unknown for lack of reliable

information on their benevolence, integrity and

competence to reciprocate

❖ universal group-based trust

both westerners (e.g. americans) and east asians (e.g.

japanese) trust ingroup more than outgroup (yamagishi,

makimura, foddy, kiyonari, & platow, 2005; yuki,

maddux, brewer, & takemura, 2005)

❖ east asian relationship-based trust

in a minimal group experimental condition, wherein

participant merely had a potential personal connection

with an outgroup member, east asians (e.g. japanese) but

not westerners (e.g. american) investors increased their

outgroup trust, possibly due to japanese’ greater relational

self and stronger cultural endorsement of interdependent

self-contrual (yuki et al., 2005)

research purpose

research so far has ignored the role of a nominal

intermediary in trust-distrust dilemmas. based on chinese

communication and guanxi characteristics relative to

australians, we hypothesised that a nominal intermediary

would increase trust and reciprocal expectation of chinese

but not australians in an experimental investment game

played between two minimal groups (“blue” versus “red”

group) method

participants. participants were 79 australians (mage = 20.81,

41 females and 38 males) recruited on the campus of australian

national university, canberra, australia; and 88 chinese

(mage = 18.97, 41 females and 47 males) from south china

normal university, guangzhou, china.

experimental design: 2 × 3 × (2) mixed design

ivs. nationality: chinese vs. australian

intermediary: intermediary absent vs. ingroup

intermediary (ii) vs. outgroup intermediary (oi)

trustee’s group membership: ingroup vs. outgroup

the intermediary absent condition represented the direct

trust situation for comparison with the intermediarymediated

trust situations represented by the ingroup and

outgroup intermediary conditions.

dvs. trust: amount of money to invest in a trustee (il)

expected reciprocity: amount of payback money expected

from the trustee (er)

investment game procedure

❖ six participants played the game at a time and were randomly

assigned to “red” or “blue” group

❖ each participant played the role of an investor to decide how much

money to invest (il) in the trustee, who was either an in-group or outgroup

member, either in the absence of an intermediary or the

presence of an in-group or out-group intermediary

❖ investment money would be doubled by the computer for the trustee

to decide how much of the doubled money to pay back to the investor

and how much to keep for self

❖ the payback money might be greater, the same as, or smaller than the

investment money

❖ before receiving the payback money from the trustee, the investor

would indicate privately the amount he/she would expect (er)

❖ each participant played the investment trust game four times with two

ingroup and two outgroup trustees in random order

results

trust

❖ in-group trust was greater than out-group trust in both

australians (ms = 6.29 vs. 5.15, f(1,76) = 30.71, p < .

001) and chinese (ms = 6.84 vs. 5.36, f(1,79) = 43.69,

p < .001)

❖ a nominal intermediary increased the trust of out-group

by chinese (ms = 5.74 vs. 5.19, f(1,151) = 3.79, p < .

05, one-tailed) but not by australians

❖ as predicted there was no intermediary effect on ingroup

expected reciprocity

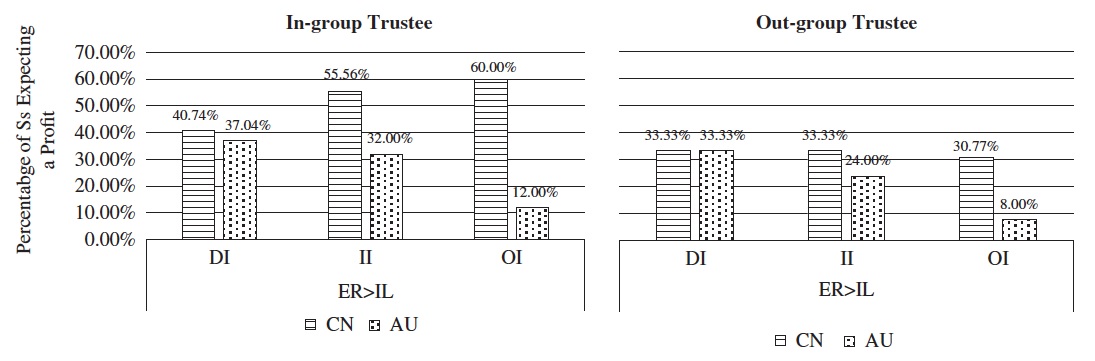

❖ for analysis investors were divided into a high (er>il)

and a low (er≤il) expectation group. the former

expected trustees to pay back a profit (gain group)

whereas the latter did not (no-gain group)

❖ preliminary test confirmed that the gain and no-gain

groups did not differ in their trust, that is, expected

reciprocity was not confounded by trust

❖ when an intermediary was present (ii & oi conditions)

more chinese than australians expected to gain from

their investment in in-group trustees; this effect of the

intermediary was not significant for out-group trustees.

conclusion

by adding a nominal intermediary to the intergroup trust game

experimental paradigm, this study has brought out variations in

intergroup trust along cultural lines. chinese, but not australians,

responded to the presence of a nominal intermediary with

increased trust in the outgroup and more common expectations

that their ingroup trustees would reciprocate by sharing the profit

from their investment.